Introduction:

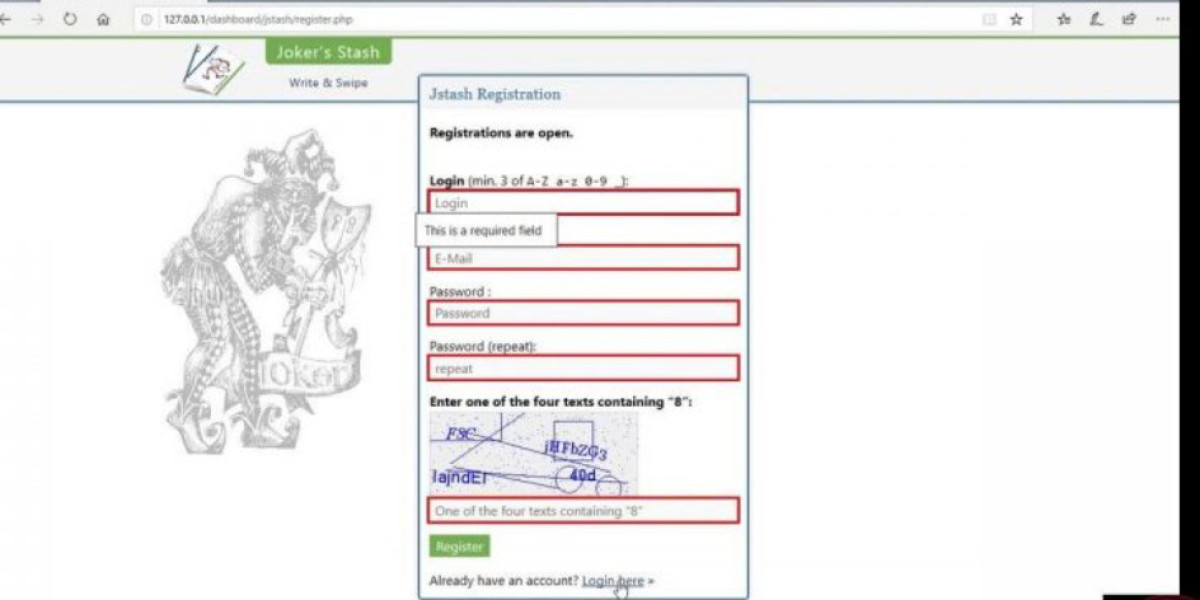

Swing trading allows traders to capitalize on short- and medium-term market movements, balancing risk and reward efficiently. Platforms like jokerstash, known for their streamlined digital operations and real-time analytics, offer valuable insights for traders. By applying the principles of speed, security, and data-driven decision-making from such marketplaces, swing traders can enhance their strategies and maximize returns in financial markets.

Key Lessons from jokerstash for Swing Traders:

Real-Time Market Monitoring:

jokerstash tracks transactions and trends in real time. Similarly, swing traders should monitor price movements, volume, and key indicators continuously to identify profitable entry and exit points.Risk Management & Security:

Just as digital marketplaces prioritize secure operations, traders must implement stop-losses, position sizing, and risk management strategies to protect their capital.Efficiency in Execution:

Fast execution is essential in both digital platforms and swing trading. Delays in trade execution can lead to missed opportunities or reduced profits.Diversification Across Assets:

JokerStash manages multiple digital assets effectively. Swing traders benefit from diversifying across stocks, commodities, or currencies to minimize exposure and stabilize returns.Data-Driven Strategy:

Analytics are the backbone of JokerStash. Swing traders should use technical indicators like moving averages, RSI, MACD, and chart patterns to make informed decisions.

Effective Swing Trading Strategies:

Trend Trading: Following the market trend using technical indicators.

Breakout Trading: Capturing trades when prices break key support or resistance levels.

Pullback Trading: Entering during temporary price reversals within the trend.

Momentum Trading: Trading assets showing strong momentum for short-term gains.

These strategies, combined with insights from JokerStash-inspired efficiency, help traders make disciplined, profitable decisions.

Conclusion:

Swing trading success relies on strategy, timing, and disciplined execution. By learning from platforms like JokerStash, traders can incorporate real-time analytics, secure practices, and efficient execution into their trades. Applying these lessons enables traders to make smarter, data-driven decisions, minimize risks, and maximize profits in short- and medium-term market movements.