In the world of finance and accounting, capital figures are among the most essential elements a business must understand. These figures play a crucial role in determining a company's financial health and future growth prospects. Whether you're a new entrepreneur or a seasoned business owner, having a clear understanding of capital figures can significantly impact your decision-making process.

In this article, we'll explore what capital figures are, how they affect business operations, and why they are important. We'll also highlight the importance of integrating proper financial strategies, including the role that Capital Figures plays in this.

What Are Capital Figures?

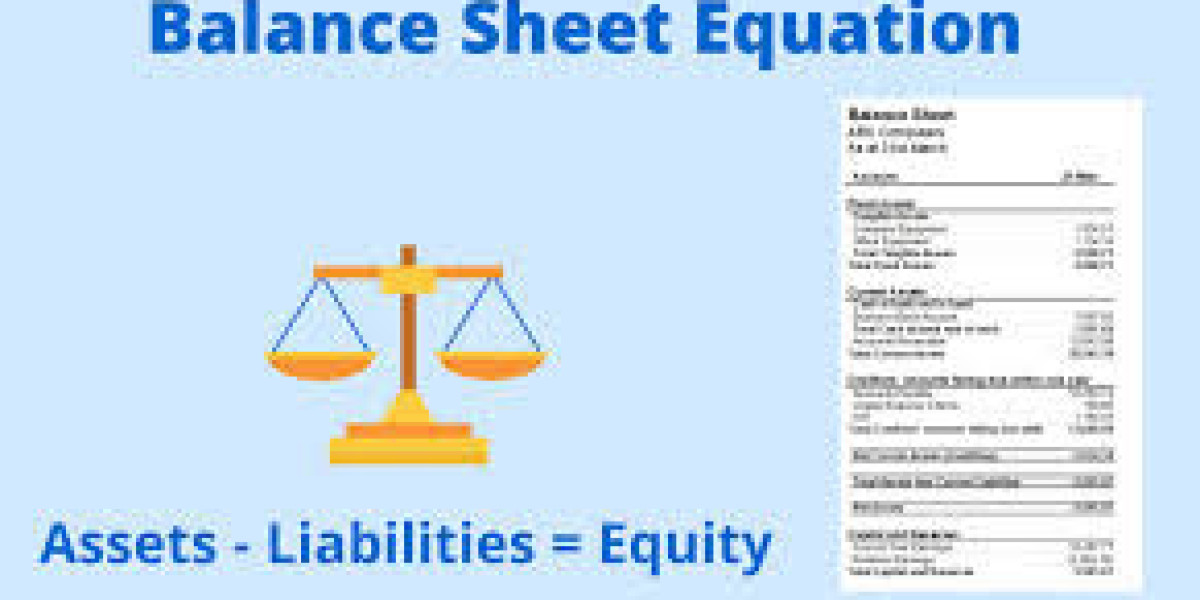

At its core, capital figures refer to the financial metrics and amounts that represent the financial standing of a business. These figures include the amount of capital invested into the business, the business's net worth, and other critical data related to its financial position.

Capital figures are often used to assess the level of investment, risk, and the overall economic health of the company. In simple terms, they are a snapshot of your company’s financial position at a given point in time.

Key Components of Capital Figures

The most common components of capital figures include:

Owner's Equity: The owner's equity represents the difference between the company’s total assets and total liabilities. This figure shows what the owner actually "owns" in the business.

Shareholder Equity: For companies with shareholders, shareholder equity reflects the ownership value that shareholders have in the company.

Debt and Liabilities: Capital figures also consider the amount of money that the business owes, including loans, outstanding bills, and other liabilities.

Retained Earnings: This refers to the profits that a company has reinvested back into the business instead of distributing them to shareholders.

Each of these components helps provide a clearer understanding of how much capital is available for business growth, operations, and potential investments.

How Capital Figures Affect Business Operations

Understanding capital figures allows business owners to make informed decisions about the financial health of their business. Capital figures have a significant impact on:

Investment Opportunities: With accurate capital figures, businesses can assess the level of capital they can invest in new projects or expansion.

Debt Management: A well-managed capital figure ensures that a business doesn't overextend itself with too much debt, which could jeopardize its financial stability.

Profitability Assessment: Capital figures help evaluate if the business is making enough profit to cover its capital expenses, ensuring long-term sustainability.

The Importance of Capital Figures for Business Growth

Access to Funding and Investment

One of the most important aspects of capital figures is their impact on attracting investors. Investors use capital figures to gauge the potential risks and returns of investing in your business. A solid capital figure signals to investors that your business is financially stable, making it easier to attract investment or secure loans.

Strategic Decision-Making

For business owners, understanding capital figures is essential for making informed strategic decisions. These figures provide insights into how much capital is available for reinvestment, which helps guide growth strategies, mergers, or acquisitions. With solid capital figures, business leaders can confidently make choices that drive growth while managing risk.

Budgeting and Financial Planning

Capital figures form the foundation for financial planning. Business owners rely on these figures to create accurate budgets that align with their financial goals. By understanding capital expenditures, retained earnings, and other components, businesses can better plan for the future, allocate resources effectively, and avoid unnecessary expenses.

The Role of Capital Figures in Financial Forecasting

Capital figures play a critical role in forecasting future financial performance. By analyzing historical capital data, businesses can make accurate predictions regarding their future cash flows, profitability, and overall financial standing. This forecasting is vital for long-term planning, allowing businesses to adapt to changing market conditions and stay ahead of competitors.

The Connection Between Capital Figures and Business Value

A company's capital figures directly influence its overall market value. The more capital a business has, the more resources it has to grow, invest, and expand. A higher capital figure generally results in higher business valuation, which is crucial when seeking investment, partnerships, or preparing for an eventual sale.

How to Improve Your Capital Figures

Improving your capital figures involves optimizing both income and expenses. Here are some tips to enhance your capital figures:

Increase Revenue: Focus on growing sales and increasing revenue through new customer acquisition, pricing strategies, or expanding your product/service offerings.

Cut Unnecessary Costs: Reducing operating expenses without sacrificing quality can lead to higher profits and, therefore, better capital figures.

Reduce Debt: Paying down outstanding debts improves your equity and financial standing, making your business more appealing to potential investors.

Reinvest Profits: By reinvesting your profits into the business, you can ensure sustainable growth, enhancing your capital figures over time.

Capital Figures and Brand Reputation

For businesses, maintaining healthy capital figures is not only important for internal financial management but also for the brand's reputation. A company that demonstrates strong capital figures sends a message to both consumers and business partners that it is financially stable, reliable, and trustworthy.

The perception of your brand is often tied to its financial health. When you maintain strong capital figures, it boosts confidence in your business, which can lead to increased customer loyalty, more partnership opportunities, and even higher sales.

Why Partnering with Capital Figures Experts Matters

While understanding capital figures is critical for every business, the process can be complex. This is where partnering with financial experts or consulting firms can be extremely beneficial. Capital Figures professionals bring their expertise in navigating the intricacies of financial reporting, helping businesses optimize their capital structure, assess risks, and capitalize on growth opportunities.

By working with experts, business owners can ensure that they are making the best financial decisions that align with their overall business objectives.

Conclusion: Capital Figures as a Cornerstone of Business Success

In conclusion, capital figures are a cornerstone of business success. They provide invaluable insight into your company's financial position, enabling you to make strategic decisions, manage risks, and plan for future growth. Whether you are looking to attract investors, improve profitability, or expand your business, understanding and optimizing your capital figures is key.

At Capital Figures, we specialize in helping businesses like yours interpret these financial metrics and use them to unlock your full potential. By understanding your capital figures, you set the foundation for long-term financial success and sustainable growth.