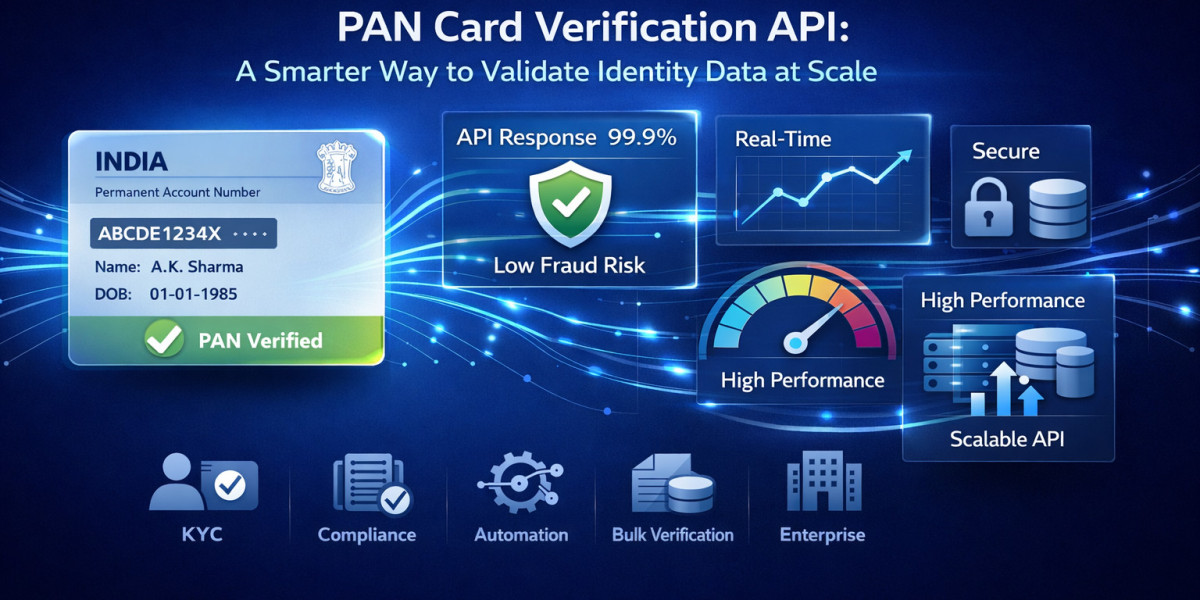

As Indian businesses increasingly operate in digital-first environments, verifying customer identity accurately has become a business necessity rather than a compliance checkbox. The Permanent Account Number (PAN) remains one of the most widely used identifiers for financial, tax, and regulatory processes. Any mismatch or invalid PAN data can create downstream issues such as failed transactions, compliance gaps, or operational delays. A PAN Card Verification API helps organisations validate PAN information instantly and maintain clean identity records from the start.

Manual verification methods, which depend on document uploads or visual checks, often fail to keep up with growing volumes. Automated verification using APIs provides a more reliable and scalable alternative.

The Role of PAN Verification in Business Operations

PAN details are deeply embedded across workflows such as onboarding, payments, lending, payroll, and reporting. When PAN data is incorrect or unverified, it can lead to reconciliation problems, regulatory scrutiny, or customer dissatisfaction. Relying on human checks increases the risk of errors, especially when onboarding happens at speed.

Using a pan number verification api allows businesses to validate PAN details at the point of submission itself. This early validation ensures that incorrect records are stopped before entering internal systems, saving time and effort later.

Understanding PAN Card Verification API

A PAN Card Verification API is a digital interface that checks the validity of a PAN number against authorised records. Once a PAN is submitted, the system performs verification in real time and returns a response almost instantly.

By integrating a pan card api into their platforms, businesses can automate PAN checks without requesting physical documents or performing manual reviews. This keeps the verification process fast, consistent, and user-friendly.

How PAN Number Verification Works

The process is straightforward and designed for speed. PAN details are securely passed through the API, which validates the information and returns a confirmation response.

This real-time verification helps businesses:

Detect invalid PAN entries immediately

Reduce manual follow-ups and rechecks

Prevent compliance issues caused by incorrect data

By validating PAN information upfront, organisations maintain reliable datasets across all systems.

Key Functions of a PAN Card API

A dependable pan card api is built to support accuracy and operational efficiency. While functionality may differ across providers, effective PAN verification APIs usually deliver:

Instant PAN validation

Clear and consistent verification results

Secure data handling and transmission

These functions make PAN verification scalable without increasing operational workload.

Where PAN Verification APIs Are Commonly Used

PAN verification APIs are used across industries that handle financial or identity-sensitive data. Banks and NBFCs rely on PAN checks during account opening and lending processes. Fintech platforms use PAN verification to onboard users quickly while reducing identity misuse.

Additional use cases include:

Employee and contractor onboarding

Vendor and supplier verification

Tax reporting and compliance workflows

Seller verification on online marketplaces

In each case, verified PAN data improves trust and audit readiness.

Business Advantages of PAN Card Verification API

Integrating a PAN Card Verification API delivers both immediate and long-term benefits. Automated checks reduce dependence on manual processes while improving accuracy.

Key advantages include:

Faster onboarding and approval cycles

Reduced risk of incorrect or duplicate PAN data

Improved compliance confidence

Lower operational costs

Automation also allows organisations to handle growing verification volumes without scaling manual teams.

Manual PAN Checks vs Automated API Verification

Manual PAN verification typically involves document uploads, screenshots, and subjective judgment. This approach is slow, inconsistent, and difficult to audit. Errors often surface only during audits or reconciliation.

In contrast, a pan no verification api ensures every PAN check follows the same validation logic. This consistency makes results easier to track, review, and audit.

Data Security and Responsible PAN Usage

PAN data is sensitive and must be protected. A trusted pan card api uses encrypted communication and controlled access to ensure that identity information is processed securely.

Digital verification also reduces the need to store physical PAN copies, lowering long-term data security risks and simplifying compliance management.

Conclusion

A PAN Card Verification API plays a critical role in modern digital identity systems. By enabling instant PAN validation, businesses can reduce errors, strengthen compliance, and streamline onboarding processes.

For organisations seeking a reliable way to validate identity data at scale, adopting a pan number verification api through a secure pan card api and pan no verification api framework is a practical and future-ready choice.