Form 6765 instructions guide businesses to claim the IRS Research and Development tax credit by calculating qualified research expenses and reporting them accurately to reduce federal tax liability.

Navigating taxes can feel like solving a Rubik’s cube in the dark. IRS Form 6765 instructions are specifically designed to help businesses claim the R&D tax credit, a powerful tool to reduce income or payroll taxes for companies that innovate.

With insights from BooksMerge, this guide will break down the process, explain eligibility, cover all line items, and clarify 2025 updates relevant for 2026 filings.

Table of Contents

What Is IRS Form 6765?

What Is Form 6765 Used For?

Who Qualifies for the R&D Tax Credit?

Understanding Qualified Research Expenses (QREs)

Structure of Form 6765

Regular Credit vs ASC Method

Step-by-Step Instructions for Form 6765

Documents Required for Form 6765

Payroll Tax Offset for Startups

What Changed in 2025?

Common Mistakes to Avoid

Why Financial Literacy Matters?

How BooksMerge Can Help?

Conclusion

FAQs

What Is IRS Form 6765?

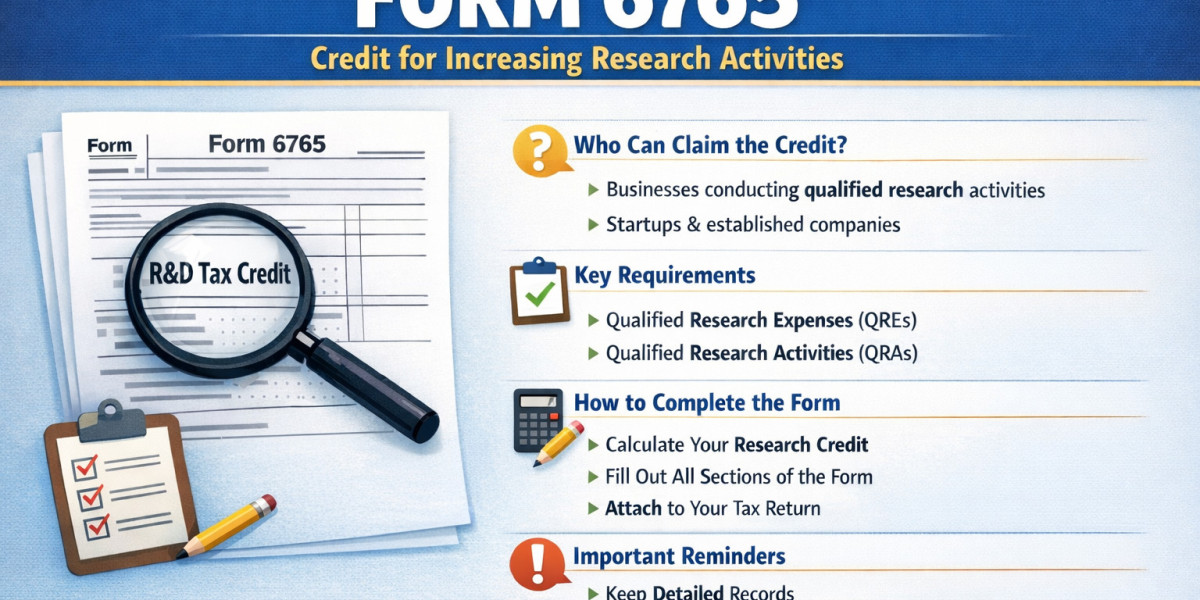

IRS Form 6765 is used by businesses to claim the federal Research and Development (R&D) tax credit. By carefully following the IRS Form 6765 Instructions, companies can accurately report qualified research expenses, calculate the allowable credits, and strategically apply them to reduce federal taxes, ensuring they do not miss out on benefits for innovation, product development, or process improvements.

What Is Form 6765 Used For?

Form 6765 instructions help companies determine eligible R&D activities and calculate the proper credit. The credit can reduce income taxes or payroll taxes for startups. Essentially, it’s a financial reward for innovation.

Use this credit to fund new projects, hire more staff, or reinvest in technology. Businesses often overlook it due to complexity, but following IRS instructions line by line prevents mistakes.

Who Qualifies for the R&D Tax Credit?

Eligible businesses include those developing new or improved:

Products

Processes

Software

Prototypes

Key points:

Businesses of any size can claim the credit.

Startups may use the payroll offset option.

Expenses must be incurred within the United States.

Not every expense qualifies. You must document activities, costs, and outcomes.

Understanding Qualified Research Expenses (QREs)

QREs are central to Form 6765 instructions. They include:

Wages for employees directly involved in R&D

Supplies used for experimentation

Contract research costs

Rental or lease costs for equipment used in research

Internal teams often confuse general operational costs with QREs. Remember: only costs directly tied to R&D activities qualify.

Structure of Form 6765

Form 6765 has multiple sections:

Part A: Regular Credit

Part B: Alternative Simplified Credit (ASC)

Part C: Payroll Tax Offset for startups

Part D: Summary of credit and carryforward

Understanding the structure is crucial to maximize your credit and avoid IRS errors.

Regular Credit vs ASC Method

Businesses can choose between:

Regular Credit Method: Uses actual QREs from the previous four years. Best for companies with detailed historical R&D expenses.

Alternative Simplified Credit (ASC): Uses a flat percentage (usually 14% of QREs exceeding 50% of average prior expenses). Simpler, but sometimes lower than regular credit.

To calculate ASC vs regular method, review historical payroll and research spending. Correct selection can increase your refund substantially.

Step-by-Step Instructions for Form 6765

Instructions Form 6765 2025/2026 are similar, with minor updates for inflation and method adjustments.

Enter basic business information.

Select your credit method (Regular or ASC).

Report QREs in the appropriate section.

Calculate the credit using the IRS formulas.

Include any carryforward or prior year credits.

If claiming payroll tax offset, complete Part C.

Review and attach supporting documentation.

Tip: Keep your calculations transparent to satisfy IRS audits.

Documents Required for Form 6765

Proper documentation is non-negotiable. Prepare:

Payroll records showing employee time on R&D

Supply invoices

Contracts with research providers

Project descriptions and technical reports

Financial statements for past four years

Without proper documentation, your claim may be denied.

Quick Note: A complete IRS form list helps businesses and individuals identify the right tax forms for filing, reporting, and claiming credits accurately.

Payroll Tax Offset for Startups

Startups can use the R&D credit to offset payroll taxes, reducing FICA liability up to $250,000 per year.

Eligibility:

Business must have gross receipts of less than $5 million

Must not have been in operation for more than 5 years

This option allows early-stage companies to invest more in growth instead of paying federal taxes.

What Changed in 2025?

Expanded eligibility for small businesses

ASC percentage adjusted slightly due to inflation

Additional guidance on startup payroll tax offsets

Enhanced documentation requirements for QREs

These changes are critical for 2026 filings. Ensure your Form 6765 instructions reflect these updates.

Common Mistakes to Avoid

Misclassifying non-R&D expenses

Forgetting payroll offset eligibility for startups

Using outdated ASC percentages

Missing carryforward credits from previous years

Avoiding mistakes ensures faster processing and prevents IRS penalties.

Why Financial Literacy Matters?

Accurate bookkeeping, payroll, and R&D tracking increase eligibility for credits. According to BooksMerge research, only 40% of small businesses track R&D expenses correctly, leaving substantial tax benefits unclaimed.

BooksMerge emphasizes the importance of clear records for both IRS compliance and strategic growth.

How BooksMerge Can Help?

BooksMerge provides professional guidance for IRS Form 6765 instructions:

Step-by-step preparation

Accurate QRE calculations

Payroll tax offset application

Compliance and audit support

For help, call +1-866-513-4656. Our experts make claiming the R&D credit simple and accurate.

Conclusion

Claiming the R&D tax credit can save your business significant taxes. Following Form 6765 instructions carefully, documenting QREs, and choosing the right method (Regular vs ASC) ensures you maximize benefits. Startups and established companies alike can benefit from payroll tax offsets and carryforward credits.

Accurate records, proper documentation, and expert guidance are key. With BooksMerge, businesses get clarity, compliance, and confidence when claiming R&D credits in 2026.

FAQs

What is Form 6765 used for?

Form 6765 is used to claim the federal R&D tax credit by reporting qualified research expenses and calculating the allowable credit to reduce federal tax liability.

Who qualifies for the R&D tax credit?

Businesses conducting eligible research activities in the U.S., including product, software, or process development, may qualify. Startups can also use the payroll offset.

What are QREs?

Qualified Research Expenses (QREs) include employee wages, supplies, contract research costs, and equipment rentals used directly in research.

How to calculate ASC vs regular method?

ASC is a simplified percentage of QREs exceeding a base amount from previous years. The regular method uses actual historical QREs for precise calculation.

What documents are required?

Payroll records, supply invoices, contracts, project reports, and financial statements are required to support the credit claim.

Can startups use payroll offset?

Yes, eligible startups with gross receipts under $5 million can use the R&D credit to offset payroll taxes up to $250,000 per year.

What changed in 2025?

Eligibility rules were expanded, ASC percentages adjusted, documentation requirements strengthened, and payroll offsets clarified for startups.

Read Also: Form 6765 Instructions